Smart Financial Planning at an Early Age: Build Wealth from the Start

Starting financial planning early is one of the smartest moves you can make.

By developing good money habits when you’re young, you give your savings more time to grow: and your financial confidence skyrockets. In this post, we’ll explore why smart financial planning at an early age matters, and how to make the most of your money right now.

What Is Smart Financial Planning?

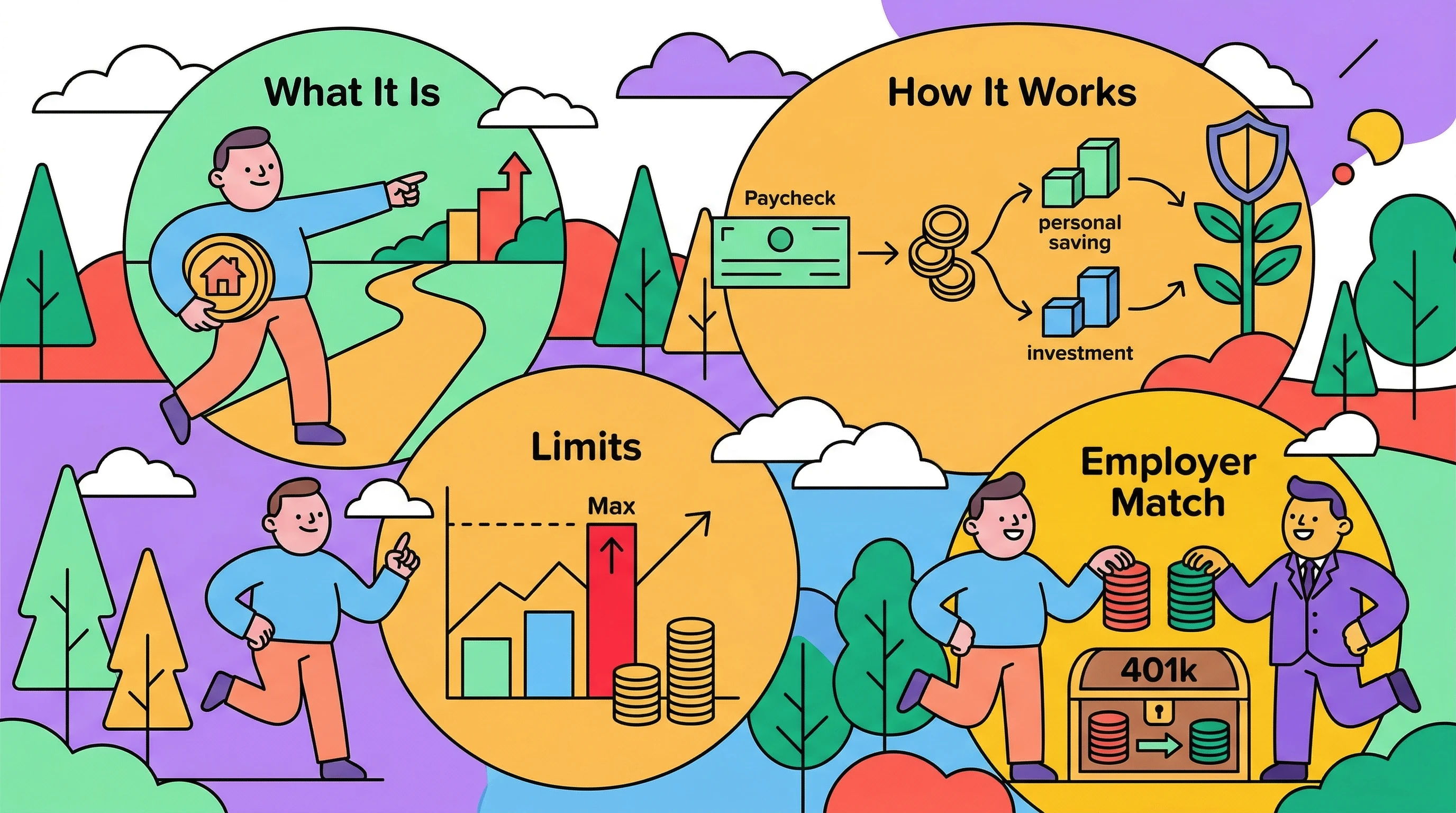

Smart financial planning is about creating a clear strategy for managing, saving, and growing your money.

When you start early, you’re not just budgeting: you’re building a strong financial foundation that can support your goals for decades to come.

Why It Matters for Young Adults

- More Time to Grow Wealth: Thanks to compound interest, small savings today can become huge in the future.

- Financial Freedom Sooner: Avoiding early debt helps you gain control faster.

- Confidence and Flexibility: A solid plan gives you the freedom to make big life decisions without financial stress.

🌱 Example:

If you start investing $100 a month at age 22 with an average 7% return, you’ll have over $250,000 by age 60. Start 10 years later, and you’d have less than half that.

How to Start Financial Planning Early

Here’s how to create a smart financial plan while you’re young:

- Set clear goals. Write down what you’re saving for: travel, a home, or financial independence.

- Track your spending. Use apps like Finny to see where your money really goes.

- Create a simple budget. Use the 50/30/20 rule to balance needs, wants, and savings.

- Start saving and investing now. Even small contributions grow over time.

- Avoid high-interest debt. Pay off credit cards in full each month.

- Build an emergency fund. Aim for 3–6 months of living expenses.

💡 Pro Tip: Automate your savings and investments. The earlier you start, the less effort it takes to grow your wealth.

Common Mistakes or FAQs

❓ What if I don’t earn much yet?

Start small. Even saving $20 a week builds consistency: and consistency matters more than amount in the beginning.

❓ Should I focus on paying off debt or saving?

Do both: pay down high-interest debt first, but always save a little to build positive habits.

❓ How can I stay motivated?

Track progress visually. Seeing your savings and investments grow over time is one of the best motivators.

Tools or Examples

Finny helps young adults take control of their finances with effortless budgeting, expense tracking, and goal-based saving tools.

It’s designed to make money management intuitive, visual, and even fun.

Other great tools to explore:

- Acorns – Automatically invests your spare change.

- Fidelity Youth Account – A great starting point for beginner investors.

Conclusion: Start Building Wealth Early

Smart financial planning at an early age is your ticket to long-term freedom and security.

By taking small, consistent steps today, you’ll give your future self the gift of confidence, flexibility, and peace of mind.

Start Planning Smarter Today

You don’t need a finance degree to plan your future: just the right mindset and tools.

Try Finny: your beautifully simple iOS finance tracker that helps you budget, track, and grow with ease.