Understanding Your Financial Analytics

Numbers tell stories: and your financial analytics reveal how you spend, save, and grow.

With the right tools, those numbers can help you make confident, data-driven decisions.

What Are Financial Analytics?

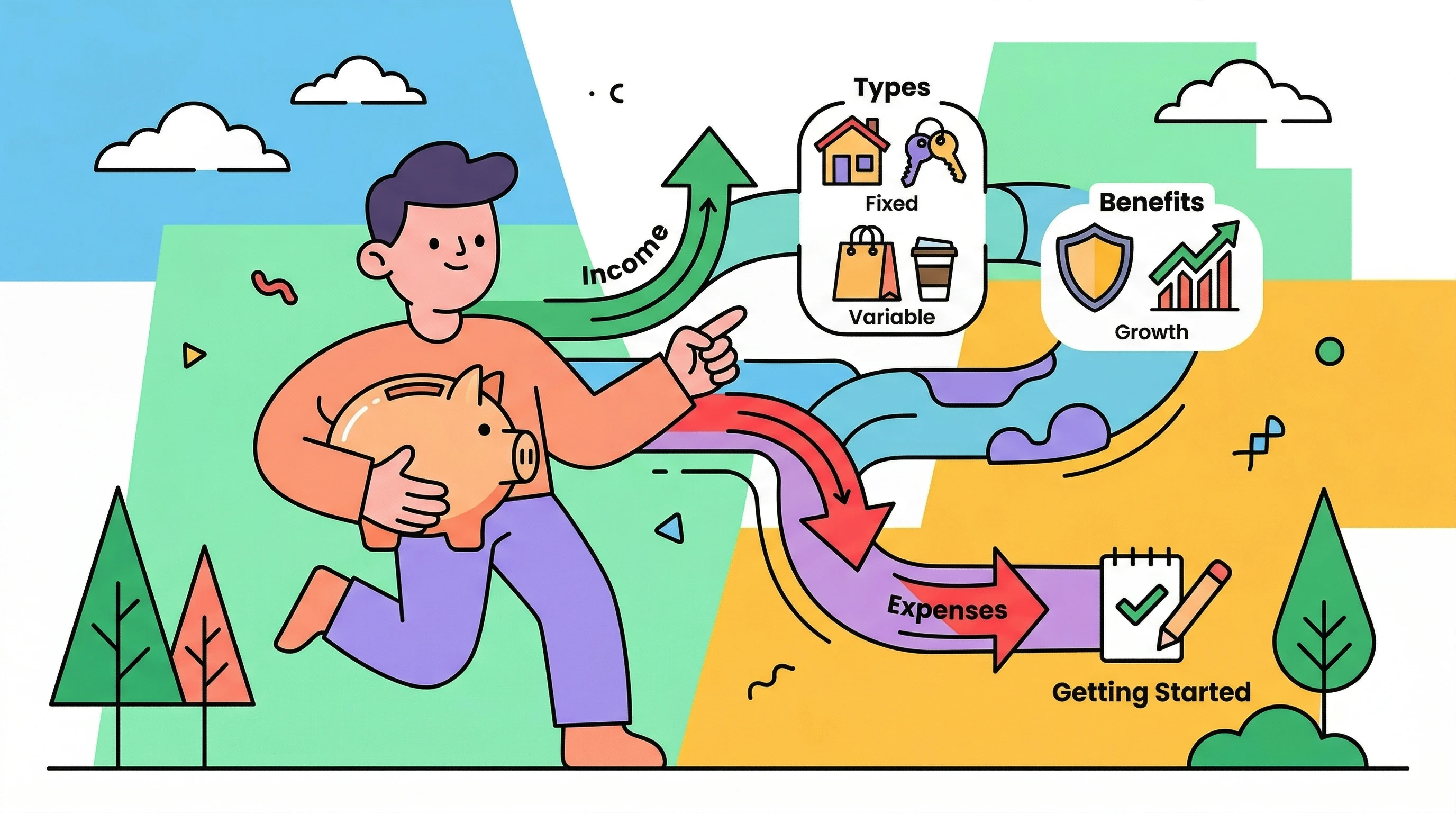

Financial analytics turn your raw transactions into meaningful patterns:

- Spending distribution by category

- Monthly trends in income vs. expenses

- Cash flow projections and savings rates

Understanding these metrics helps you make smarter financial choices, not just track numbers.

Why Analytics Matter

- Clarity: Know where your money really goes

- Control: Identify waste and adjust early

- Confidence: Use facts, not guesswork, to plan your goals

Finny’s analytics dashboard gives you clear visual insights to make better decisions faster.

Key Metrics to Monitor

- Expense-to-Income Ratio – Measures your monthly balance health

- Top Spending Categories – Reveals habits and triggers

- Savings Growth Over Time – Tracks your long-term progress

- Recurring vs. Variable Expenses – Identifies where automation can help

Turning Data into Action

Data is only useful if it leads to change. Review your analytics weekly:

- Spot unusual spikes

- Adjust category limits

- Refine your budget goals

💡 Tip: Treat your analytics as feedback, not judgment. Small improvements compound over time.

Transform Your Data into Financial Power

With Finny, you don’t need to be a data analyst to understand your money.

Visual dashboards, smart insights, and actionable trends help you stay ahead with clarity.