Most budgets leave money unassigned. You pay bills, buy groceries, and whatever remains floats in your checking account until it disappears into random purchases. At month-end, you wonder where it went.

Zero-based budgeting eliminates this problem by assigning every dollar a specific purpose before you spend it. Income minus allocations equals zero. Not because you spent everything, but because every dollar has a job: bills, groceries, savings, debt payoff, entertainment. Nothing is left unaccounted.

This guide explains how zero-based budgeting works, walks through implementation step by step, and shows how to adapt it to your situation. For other budgeting approaches, see our guide on budgeting for beginners.

What Is Zero-Based Budgeting

Zero-based budgeting (ZBB) is a method where you allocate all income to specific categories until the remaining balance equals zero.

The formula: Income - All Allocations = $0

This does not mean spending everything. Savings and investments are allocations too. "Giving every dollar a job" means deciding in advance where each dollar goes, whether that destination is a bill, a purchase, or a savings account.

Example: Monthly income: $4,500

| Allocation | Amount |

|---|---|

| Rent | $1,400 |

| Utilities | $180 |

| Groceries | $450 |

| Transportation | $350 |

| Insurance | $200 |

| Phone | $80 |

| Subscriptions | $50 |

| Dining out | $200 |

| Entertainment | $100 |

| Personal care | $75 |

| Emergency fund | $400 |

| Retirement | $300 |

| Sinking funds | $200 |

| Debt extra payment | $300 |

| Miscellaneous | $215 |

| Total Allocations | $4,500 |

Income minus allocations: $4,500 - $4,500 = $0

Every dollar is assigned. The budget is "zeroed out."

How Zero-Based Budgeting Differs from Other Methods

vs 50/30/20 Budgeting

The 50/30/20 method divides income into three buckets (50% needs, 30% wants, 20% savings) without detailed category allocation. Zero-based budgeting specifies exactly where every dollar within those buckets goes.

50/30/20 is simpler but less precise. Zero-based budgeting requires more effort but provides complete control.

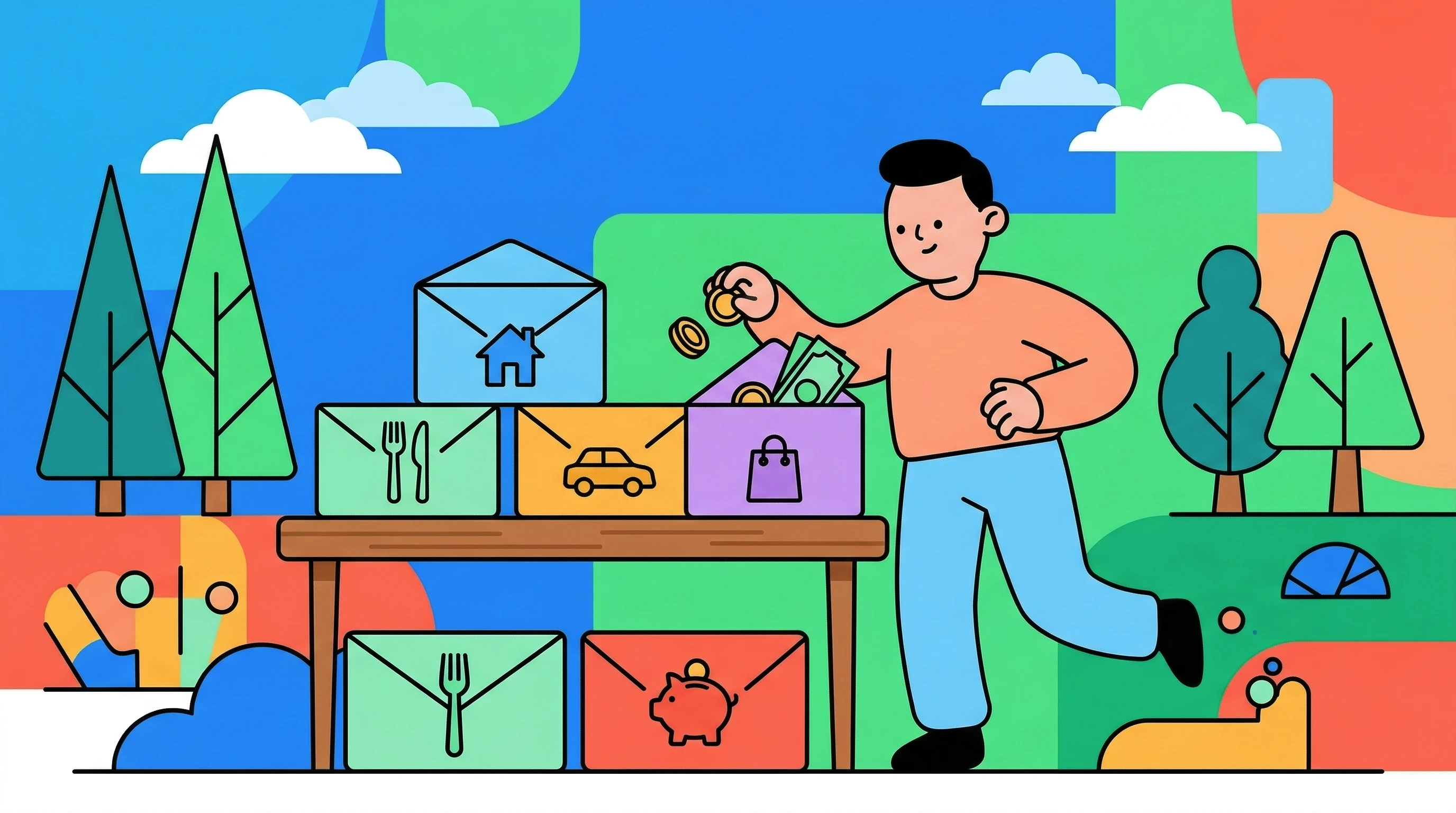

vs Envelope Budgeting

Envelope budgeting divides cash into physical or digital envelopes for each category. Zero-based budgeting is the planning framework that determines how much goes in each envelope.

They can work together: use zero-based planning to set envelope amounts.

vs "Pay Yourself First"

Pay yourself first prioritizes savings by transferring to savings immediately when income arrives. Zero-based budgeting includes this concept: savings categories get allocated just like expense categories.

The difference is scope. Pay yourself first focuses on savings priority. Zero-based budgeting covers all money comprehensively.

Why Zero-Based Budgeting Works

Eliminates "Leftover" Money

Unallocated money gets spent unconsciously. Zero-based budgeting removes this leak by assigning everything before spending begins.

Forces Intentional Decisions

When every dollar needs a destination, you must think about priorities. Is $200 for dining more important than $200 for debt payoff? You decide explicitly rather than letting inertia decide.

Reveals True Costs

Allocating money to every category shows the real cost of your lifestyle. Many people discover they need more income or fewer expenses once they see all categories together.

Creates Accountability

A detailed budget provides clear benchmarks. Did you exceed your grocery allocation? You know immediately and can adjust.

Adapts to Changing Income

Each month starts fresh. Income changes? Allocate accordingly. Zero-based budgeting handles irregular income naturally because you work with actual money, not projections.

How to Create a Zero-Based Budget

Step 1: Calculate This Month's Income

List all income expected this month:

- Salary (after taxes)

- Side income

- Regular payments from others

- Investment dividends (if used for expenses)

Use actual expected amounts, not averages. If this month's income differs from last month, allocate based on this month's reality.

Variable income approach: If income is unpredictable, budget based on confirmed income only. As additional income arrives, allocate it immediately.

Step 2: List All Expense Categories

Create categories that match your spending patterns:

Fixed expenses:

- Housing (rent or mortgage)

- Utilities

- Insurance (health, car, renters)

- Loan payments

- Subscriptions

- Phone

Variable necessities:

- Groceries

- Gas/transportation

- Healthcare (copays, medications)

- Household supplies

Discretionary:

- Dining out

- Entertainment

- Shopping

- Hobbies

- Personal care

Financial goals:

- Emergency fund

- Retirement contributions

- Debt extra payments

- Sinking funds (see what is a sinking fund)

- Savings goals

Buffer:

- Miscellaneous/unexpected

Step 3: Assign Every Dollar

Work through categories systematically:

- Start with fixed expenses: These are usually non-negotiable

- Add variable necessities: Use historical spending as a guide

- Include financial goals: Treat savings like a required expense

- Allocate discretionary spending: Based on remaining money

- Add a miscellaneous buffer: For unexpected small expenses

Keep allocating until income minus allocations equals zero.

If allocations exceed income: Cut discretionary categories first. If still over, examine necessities for reductions. If impossible to balance, you have a structural income problem.

If income exceeds allocations: Add more to savings, debt payoff, or sinking funds. Do not leave money unallocated.

Step 4: Track Spending Against Allocations

A budget means nothing without tracking. As you spend, record expenses against their categories.

Finny helps by automatically categorizing expenses and showing progress against your allocations. You see in real-time: "I have spent $320 of my $450 grocery allocation."

Track daily or at least weekly. Waiting until month-end to review is too late to make adjustments.

Step 5: Adjust Mid-Month When Necessary

Real life does not follow budgets perfectly. When overspending happens in one category, move money from another.

Example: Unexpected car repair costs $300. Move $150 from dining out and $150 from entertainment to cover it. The budget stays balanced.

These adjustments are normal, not failures. The goal is keeping total spending within total income, not perfect adherence to each category.

Step 6: Start Fresh Each Month

At month-end, evaluate what worked and what did not. Create next month's budget based on:

- Actual income expected

- Any upcoming irregular expenses

- Lessons learned from this month

Each month is a new opportunity to allocate wisely.

Zero-Based Budget Example

Monthly income: $5,200

| Category | Allocation | Notes |

|---|---|---|

| Rent | $1,500 | Fixed |

| Utilities | $150 | Average, adjust seasonally |

| Car payment | $350 | Fixed |

| Car insurance | $120 | Fixed |

| Gas | $180 | Variable |

| Groceries | $500 | Family of 2 |

| Phone | $90 | Fixed |

| Internet | $60 | Fixed |

| Streaming | $35 | Fixed |

| Health insurance | $200 | Fixed (employer portion) |

| Dining out | $250 | Discretionary |

| Entertainment | $100 | Discretionary |

| Clothing | $75 | Discretionary |

| Personal care | $60 | Haircuts, products |

| Emergency fund | $300 | Building to 6 months |

| Retirement 401k | $400 | Additional to employer match |

| Vacation sinking fund | $150 | Annual trip |

| Car maintenance fund | $80 | Sinking fund |

| Holiday gift fund | $50 | Sinking fund |

| Student loan extra | $200 | Beyond minimum |

| Miscellaneous | $150 | Buffer |

| Total | $5,200 |

Income: $5,200 Allocations: $5,200 Difference: $0

Budget is zeroed out. Every dollar has a destination.

Zero-Based Budgeting with Irregular Income

Freelancers, contractors, and commission earners can use zero-based budgeting with modifications:

Budget When Money Arrives

Instead of monthly planning, allocate each payment as it arrives:

- Client pays $2,500

- Immediately allocate: $800 to bills, $500 to groceries, $400 to savings, etc.

- Next payment arrives, repeat

Prioritize Allocations

Create a priority list for when income is lower than expected:

- Housing

- Utilities

- Food

- Transportation

- Insurance

- Minimum debt payments

- Emergency fund contribution

- Other savings

- Discretionary

In lean months, fund from the top down. Higher-income months fund everything plus extra savings.

Build a Larger Buffer

Variable income requires more cushion. Aim for a larger miscellaneous category and a fuller emergency fund than fixed-income earners need.

Common Zero-Based Budgeting Mistakes

Not Including All Categories

Forgetting annual subscriptions, quarterly insurance payments, or holiday spending leaves money unaccounted. List everything, including irregular expenses (use sinking funds for these).

Setting Unrealistic Allocations

Allocating $100 for groceries when you actually spend $400 guarantees failure. Base allocations on actual spending, then gradually reduce problem areas.

Forgetting to Track

A zero-based budget without tracking is fantasy. The budget tells you the plan; tracking tells you reality. Compare them continuously.

Being Too Rigid

Life happens. A budget that cannot flex breaks instead of bends. Keep a miscellaneous category. Allow mid-month reallocations. Perfection is not the goal; direction is.

Starting Over When You Fail

One bad month does not erase progress. Analyze what went wrong, adjust the approach, and continue. Consistency over time matters more than any single month.

Tools for Zero-Based Budgeting

| Tool | Zero-Based Support | Cost | Notes |

|---|---|---|---|

| YNAB | Designed for ZBB | $99/year | Gold standard for zero-based |

| Finny | Category tracking | Free | Good for expense tracking |

| EveryDollar | Built for ZBB | Free/Premium | Dave Ramsey method |

| Spreadsheet | Fully customizable | Free | Requires manual setup |

| Pen and paper | Works if consistent | Free | Simple but labor-intensive |

YNAB is specifically built around zero-based principles. Finny works well for the tracking side, showing where money actually goes against your planned allocations.

Zero-Based Budgeting and Other Strategies

With Sinking Funds

Zero-based budgeting and sinking funds work perfectly together. Create allocation categories for each sinking fund:

- "Car insurance sinking fund": $100/month

- "Holiday gift sinking fund": $50/month

- "Vacation sinking fund": $150/month

Money allocates monthly; funds accumulate for future expenses.

With Pay Yourself First

Include savings as your first allocations after fixed expenses. This ensures savings happen before discretionary spending gets assigned.

With Debt Payoff

Allocate minimum payments as fixed expenses. Allocate extra debt payments as a financial goal category. Zero-based budgeting makes debt payoff intentional rather than "whatever is left."

The Bottom Line

Zero-based budgeting assigns every dollar a specific purpose until income minus allocations equals zero. This comprehensive approach eliminates untracked spending, forces intentional decisions, and provides complete visibility into your financial life.

The method requires more effort than simpler budgeting approaches. You must list all categories, allocate monthly, track spending, and adjust as needed. But the control it provides justifies the effort for people who want to know exactly where their money goes.

Start by tracking current spending to understand your real patterns. Create categories that match your life. Allocate income until the budget zeros out. Track spending against allocations. Adjust and improve each month.

Zero-based budgeting transforms budgeting from vague intention to precise action. Every dollar has a job, and you assigned it.

Common Questions About Zero-Based Budgeting

What is zero-based budgeting in simple terms?

Zero-based budgeting means assigning every dollar of income to a specific category until nothing is left unallocated. Income minus all allocations equals zero. This includes savings and investments, not just spending.

Does zero-based budgeting mean spending all my money?

No. Savings, investments, and debt payments are allocations too. "Zero" means nothing unassigned, not nothing saved. A good zero-based budget includes significant allocations to financial goals.

How is zero-based budgeting different from a regular budget?

Regular budgets often leave money unassigned or use vague categories. Zero-based budgeting requires accounting for every dollar specifically. Nothing floats untracked in your checking account.

Is zero-based budgeting good for beginners?

It can work for beginners willing to put in the effort. Simpler methods like 50/30/20 require less tracking. Zero-based budgeting provides more control but demands more attention.

What if my income varies every month?

Budget based on actual income when it arrives rather than projections. Prioritize allocations so essential categories get funded first in lower-income months. Build a larger buffer for income variability.

Ready to implement zero-based budgeting with clear expense tracking?

Download Finny to track spending against your budget allocations, see where every dollar goes, and maintain control over your financial life. Detailed tracking makes zero-based budgeting work.