You earn money. You spend money. At the end of the month, you wonder where it all went. This cycle repeats until something changes: either you run out of money at a critical moment, or you decide to take control before that happens.

Budgeting for beginners does not require spreadsheets, accounting knowledge, or hours of work each week. It requires one thing: knowing where your money goes. Once you see the numbers clearly, decisions become obvious. This guide walks you through creating your first budget, choosing a method that fits your life, and building habits that stick.

For a comparison of tools that can help, see our guide on best money tracker apps in 2026.

What Is a Budget

A budget is a plan for your money. It answers two questions:

- How much money do I have coming in?

- How will I spend and save that money?

The simplest budget compares income to expenses. If you earn $4,000 monthly and spend $3,800, you have $200 left for savings or debt payoff. If you spend $4,200, you are going backward each month.

A budget does not restrict your life. It reveals your choices. Without a budget, spending happens unconsciously. With a budget, you decide what matters and fund those things intentionally.

Why Budgeting Matters

Prevents Financial Surprises

Budgeting exposes problems before they become crises. If your expenses exceed income, you see it immediately rather than discovering it through overdraft fees or mounting credit card balances.

Aligns Spending with Values

Most people spend money on things that do not actually matter to them. A budget forces examination: is $300 monthly on dining out worth more than the vacation you keep postponing? You decide consciously rather than letting habits decide for you.

Enables Financial Goals

Saving for a house, paying off debt, building an emergency fund: these goals require money set aside consistently. A budget creates space for goals by accounting for them before discretionary spending.

Reduces Financial Stress

Money anxiety often comes from uncertainty. A budget replaces "I hope I have enough" with "I know exactly where I stand." This clarity reduces stress even when the numbers are not ideal.

How to Create Your First Budget

Step 1: Calculate Your Income

List all money coming in each month:

- Salary or wages (after taxes)

- Side income or freelance work

- Regular transfers from others

- Any other consistent income

Use take-home pay, not gross income. The number that matters is what actually hits your account.

Example:

| Income Source | Monthly Amount |

|---|---|

| Salary | $3,800 |

| Freelance work | $400 |

| Total Income | $4,200 |

If your income varies, use the average of the past 3-6 months. For highly irregular income, base your budget on your lowest typical month.

Step 2: Track Your Current Spending

Before setting limits, understand reality. Track every expense for at least one month. You can do this by:

- Reviewing bank and credit card statements

- Using an expense tracking app like Finny

- Keeping receipts and logging manually

Categorize spending as you track. Common categories include:

Fixed expenses (same amount monthly):

- Rent or mortgage

- Car payment

- Insurance premiums

- Subscriptions

- Loan payments

Variable necessities (amounts fluctuate):

- Groceries

- Utilities

- Gas or transportation

- Healthcare

Discretionary spending (optional):

- Dining out

- Entertainment

- Shopping

- Hobbies

Most people are surprised by their actual spending. The coffee runs, delivery fees, and impulse purchases add up faster than expected.

Step 3: Compare Income to Spending

Add up your total spending and compare to income.

Scenario A: Spending less than income You have margin to allocate toward savings and goals. The question becomes: where should the surplus go?

Scenario B: Spending equals income You are breaking even but building nothing. Any unexpected expense requires debt. Find categories to reduce.

Scenario C: Spending exceeds income This is unsustainable. Debt is growing. Identify cuts immediately, starting with discretionary categories.

Step 4: Set Category Limits

Based on your analysis, assign limits to each category. For more on setting effective limits, see our guide on what is a spending limit.

Start with fixed expenses since these are usually non-negotiable. Then allocate to necessities based on historical spending. Finally, divide remaining money between discretionary spending and financial goals.

Example budget:

| Category | Limit |

|---|---|

| Rent | $1,400 |

| Utilities | $150 |

| Car payment + insurance | $400 |

| Groceries | $400 |

| Gas | $150 |

| Subscriptions | $50 |

| Dining out | $200 |

| Entertainment | $100 |

| Personal care | $75 |

| Savings | $300 |

| Emergency fund | $200 |

| Miscellaneous | $175 |

| Total | $3,600 |

If income is $3,600, this budget balances. If income is $4,200, you have an extra $600 for additional savings or debt payoff.

Step 5: Track and Adjust

A budget is not a one-time document. It requires ongoing tracking:

- Log expenses as they happen or review weekly

- Compare actual spending to limits

- Adjust when categories consistently over or underspend

Finny automates much of this tracking. Expenses categorize automatically, and you can see your progress against limits in real time.

Popular Budgeting Methods

Different methods work for different personalities. Try one and switch if it does not fit.

The 50/30/20 Rule

Allocate income into three buckets:

- 50% Needs: Housing, utilities, groceries, transportation, insurance, minimum debt payments

- 30% Wants: Dining out, entertainment, shopping, hobbies, subscriptions

- 20% Savings and Debt: Emergency fund, retirement, extra debt payments

This method is simple and flexible. It works well if you want guidelines without detailed tracking.

Example on $4,000 income:

- Needs: $2,000

- Wants: $1,200

- Savings/Debt: $800

Zero-Based Budgeting

Every dollar gets assigned a purpose until income minus allocations equals zero. Nothing is left unaccounted.

This method requires more detail but provides complete control. For a deeper dive, see our guide on zero-based budgeting.

Example: Income: $4,000 Allocations: Rent ($1,400) + Groceries ($400) + Utilities ($150) + Transportation ($300) + Dining ($200) + Entertainment ($100) + Savings ($500) + Emergency Fund ($300) + Debt Extra ($400) + Misc ($250) = $4,000

Pay Yourself First

Savings come out immediately when income arrives. You live on whatever remains. This method prioritizes wealth building over consumption.

For more on this approach, see what is pay yourself first.

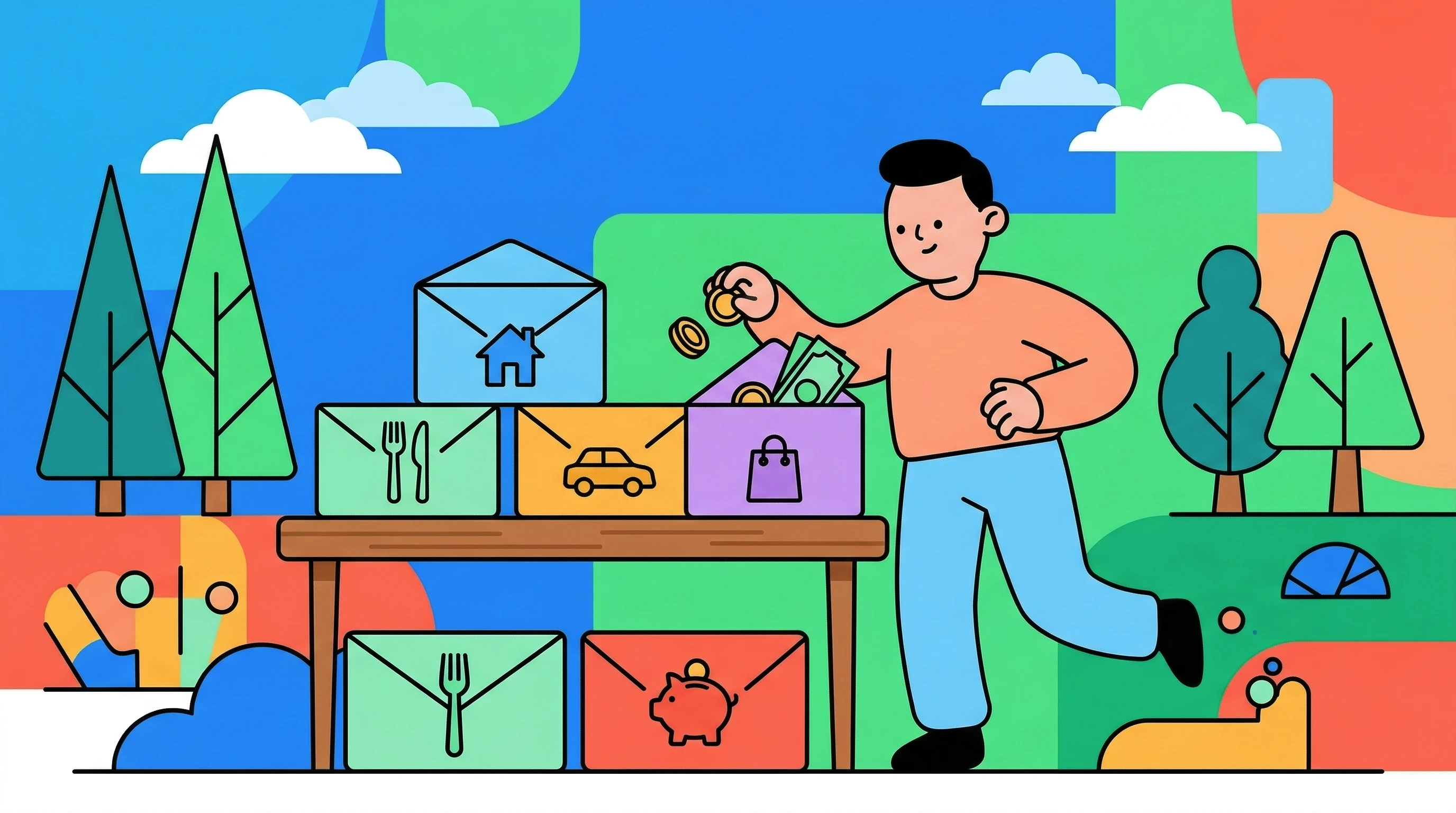

Envelope System

Cash is divided into physical or digital envelopes for each category. When an envelope is empty, spending in that category stops until next month.

This creates hard limits that prevent overspending. It works well for discretionary categories that tend to blow up.

Common Budgeting Mistakes

Setting Unrealistic Limits

Cutting your dining budget from $400 to $50 will fail. Start with modest reductions (10-20%) and tighten over time. Sustainable change beats dramatic failure.

Forgetting Irregular Expenses

Car registration, annual subscriptions, holiday gifts, and quarterly insurance payments are real expenses. Account for them by dividing annual costs by 12 and setting aside money monthly. These are called sinking funds: see our guide on what is a sinking fund.

Not Tracking

A budget you do not track against is just a wish. Review spending at least weekly. Catching overspending early allows adjustment; discovering it at month-end is too late.

Being Too Rigid

Budgets need flexibility for real life. Include a miscellaneous category for unexpected expenses. Allow occasional treats without guilt if your overall plan stays on track.

Giving Up After Mistakes

One overspent month does not mean budgeting failed. Analyze what happened, adjust the budget if needed, and continue. Progress comes from consistency over time, not perfection.

Budgeting Tools Comparison

| Tool | Best For | Approach | Cost |

|---|---|---|---|

| Finny | Simple tracking with AI | Manual + AI assist | Free |

| YNAB | Zero-based budgeting | Proactive allocation | $99/year |

| Monarch | Bank-linked overview | Automatic import | $99/year |

| Spreadsheet | Full customization | Manual tracking | Free |

| Pen and paper | Minimal tech | Manual tracking | Free |

The best tool is one you will actually use. Start simple and add complexity only if needed.

Building Budgeting Habits

Automate What You Can

Set up automatic transfers for savings and bills. Money that moves automatically does not require willpower each month.

Schedule Weekly Reviews

Pick a day each week (Sunday evening works for many people) to review the past week and plan the next. Ten minutes prevents month-end surprises.

Use Visual Progress Tracking

Seeing progress motivates continuation. Track your emergency fund growing, your debt shrinking, or your savings goals advancing. Visual feedback reinforces the habit.

Start with One Category

If full budgeting feels overwhelming, start by tracking one problem category (often dining or shopping). Master that, then expand to others.

Budgeting on Irregular Income

Freelancers, contractors, and commission earners face extra challenges. Strategies that help:

Base Budget on Low Months

Build your budget assuming income at the lower end of your range. Months that exceed this become opportunities to save extra or pay down debt.

Prioritize Essential Expenses

List expenses in priority order. In low-income months, fund from the top down. In high-income months, everything gets funded plus savings.

Build a Larger Buffer

Variable income requires more emergency savings. Aim for 6+ months of expenses rather than the standard 3-6 months.

Smooth Income with a Holding Account

Deposit all income into a holding account. Pay yourself a consistent "salary" from this account each month. This creates stability from irregular sources.

The Bottom Line

Budgeting for beginners starts with one question: where is your money going? Track spending for a month, compare to income, and set limits that align with your values and goals.

The specific method matters less than consistency. Whether you use 50/30/20, zero-based budgeting, or a simple spreadsheet, the act of paying attention to money changes how you spend it.

Start today with whatever system seems manageable. You can always refine your approach once the basic habit is established. The goal is not a perfect budget but an aware relationship with your money.

Common Questions About Budgeting

What is the best budgeting method for beginners?

The 50/30/20 rule offers the simplest starting point: 50% needs, 30% wants, 20% savings. It provides structure without requiring detailed tracking of every expense.

How much should I budget for groceries?

Most individuals spend $250-400 monthly; families spend more. Track your actual spending first, then set a limit based on your reality and goals.

What if I cannot stick to my budget?

Review which categories you overspend. If limits are unrealistic, adjust them. If tracking is inconsistent, try a different method or tool. Budgets should evolve with experience.

Do I need a budgeting app?

No, but apps reduce friction. Manual tracking works if you commit to it. Apps like Finny automate categorization and provide visual progress tracking that helps many people stay consistent.

How long does it take to see results from budgeting?

Most people notice improved awareness within the first month. Meaningful financial progress (growing savings, reducing debt) typically becomes visible within 3-6 months of consistent budgeting.

Ready to start budgeting with clear expense tracking?

Download Finny to track every expense, set category limits, and see exactly where your money goes. Simple tracking leads to confident financial decisions.